Survey: Certified Divorce Financial Analyst® (CDFA™) Professionals Reveal the Leading Causes of Divorce

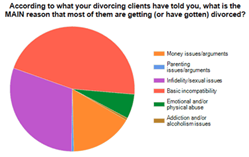

According to a recent survey of 191 CDFA professionals from across North America, the three leading causes of divorce are basic incompatibility (43%), infidelity (28%), and money issues (22%). As experts in divorce and finance, professionals certified by the Institute for Divorce Financial Analysts discuss the relationship between financial issues and divorce.

•

According to CDFA professionals, the leading causes of divorce are incompatibility, infidelity, and money issues.

“I have long believed financial disagreements to be the most common cause of marital conflict and ultimately divorce. Now we have empirical evidence proving this is the case across all socio-economic classes. – Justin A. Reckers (CFP, CDFA)“Durham, NC (PRWEB) August 30, 2013

If you think that incompatibility, infidelity, and money issues can lead a couple straight to divorce, you might just be right.

According to an August 2013 survey of 191 CDFA professionals from across North America, the three leading causes of divorce are basic incompatibility (43%), infidelity (28%), and money issues (22%). “Many couples lack the communication skills necessary to navigate financial disagreements in their marriage,” noted one respondent. “The emotional connection of money with safety and security in many people makes the financial disagreements more salient than other disagreements.”

“The incompatibility is usually caused by one or more of the other choices,” another CDFA professional added.

Several of the CDFA professionals surveyed noted that the most commonly-cited cause of divorce they hear from their clients – “basic incompatibility” – is usually created by deeper issues somewhere in the relationship – usually an emotional, physical, or financial breech of trust. This may help to explain the difference in findings between this survey and the findings of a 2012 academic study. “Examining the Relationship Between Financial Issues and Divorce” published in the Family Relations journal (v. 61, No. 4, Oct. 2012), looked at data for 4,574 couples as part of the U.S.-based “National Survey of Families and Households”. In the study, researchers Jeffrey Dew, Sonya Britt, and Sandra Huston examined data related to what couples argue about – including children, money, in-laws, and spending time together – and then looked at which of those couples were divorced four to five years later. According to the study, financial disagreements were the strongest disagreement types to predict divorce for both men and women.

In a poll conducted by http://www.DivorceMagazine.com this summer, the leading cause of divorce was found to be financial issues, followed closely by basic incompatibility. “During the divorce, the two most contentious issues are usually finances and children – in that order,” says Dan Couvrette, publisher of Divorce Magazine. “If there are no children, then basic incompatibility and communication problems follow on the heels of money problems.”

“I have long believed financial disagreements to be the most common cause of marital conflict and ultimately divorce,” says Justin A. Reckers, a CDFA professional based in Dan Diego, CA. “Now we have empirical evidence proving this is the case across all socio-economic classes.” Disparate goals and values around money coupled with the power and control financial prosperity represents makes money a common battle ground in marriages, Reckers adds. During their divorce, a couple may be playing out the same financial conflicts they had during their marriage. “Research is telling us to be cautious because these financial disagreements may have been the building blocks for the conflict that ended their marriage in the first place,” Reckers points out. As a CDFA professional, he helps couples to “realize their financial conflicts are usually just difficult decision-making processes set against the back-drop of competing goals and values. When clients realize this, the conflict becomes manageable and cases settle,” Reckers concludes.

If marriage is all about love, then divorce is all about money. “And when people are going through a divorce, they must keep their focus on the money,” says Jeffrey A. Landers, a CDFA professional based in New York, NY. The author of “Divorce: Think Financially, Not Emotionally” (Sourced Media Books, 2012), Landers adds that divorces are now much more financially complicated than they were just ten or 15 years ago. “Today, it’s not unusual for marital assets to include residential and commercial real estate, sophisticated financial investments, complex employee compensation packages, and closely-held businesses or professional practices,” he says. “Finances, financial projections and analyses aren’t taught in law school – and good divorce attorneys understand they don’t have the expertise and/or the time to handle the financial complexities of their clients’ cases.” This means that more and more divorce attorneys are now encouraging their clients to hire a skilled CDFA professional to assist in their case.

“If a divorcing person hopes to lock in a secure financial future for themselves and their children, then it is vitally important to have a divorce financial advisor on their team,” asserts Landers. “And not just any financial advisor: they need one with the training and experience to handle their specific set of circumstances.”

CDFA professionals are found throughout the US and Canada, from California to New York to Toronto. For more information about how CDFA professionals help divorcing couples make better financial decisions, visit http://www.InstituteDFA.com.

Collaborative Law Professionals of WNY members Adrienne Rothstein Grace and Jennifer Jurek are Certified Divorce Financial Analysts (CDFA).

Leave A Comment